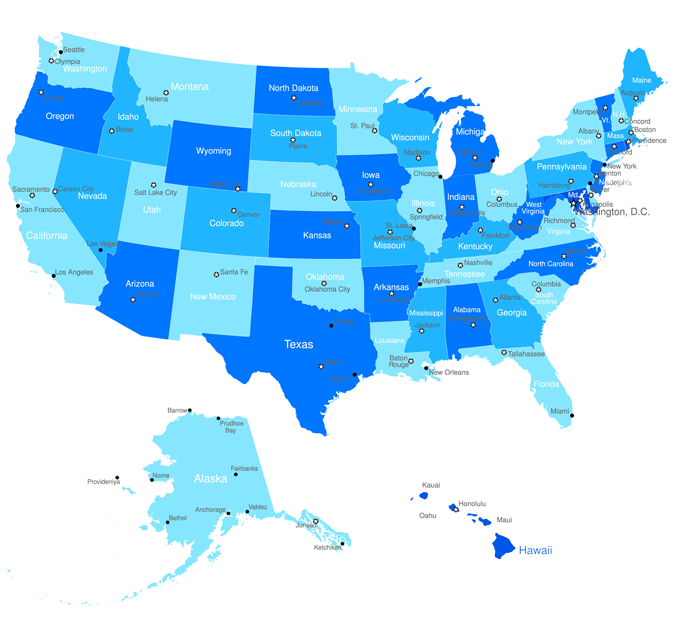

Click on Your State for Federal and Local Energy Tax Credits

Click on Your State for Federal Renewable Energy Tax Credit Program Details

Harnessing the Power of the Sun: Solar and other Energy Tax Incentivesg

In today's climate-conscious world, switching to renewable energy is no longer a fringe concern but a mainstream necessity. As individuals and governments strive to reduce their carbon footprint, solar energy emerges as a shining star, offering a clean and sustainable alternative to traditional fossil fuels. To further accelerate this transition, various tax incentives are being implemented worldwide, making solar and other renewable energy sources more accessible and cost-effective.

Tax Incentives for Solar Energy

The primary tax incentive for solar energy is the **Federal Solar Investment Tax Credit (ITC)**, currently at 30% of the total cost of a solar energy system installed on a residential or commercial property. This credit can be applied to the federal income tax owed, significantly reducing the upfront cost of going solar. Additionally, many states offer their own tax credits, rebates, and other financial incentives, further sweetening the deal for homeowners and businesses considering solar. These incentives can vary depending on location and program specifics, but they often include:

- Property tax exemptions:** Certain states exempt solar energy systems from property tax assessments, reducing the overall financial burden.

- Net metering:** This allows solar energy system owners to sell excess energy they generate back to the grid, receiving credits that can be used to offset future electricity bills.

- Sales tax exemptions:** Some states exempt solar energy systems from sales tax, making them even more affordable.

Beyond Solar: Incentives for Other Renewables

While solar energy enjoys the spotlight, other renewable energy sources also benefit from various incentives. These include:

- Wind energy:** The federal Production Tax Credit (PTC) provides a tax credit for wind energy producers based on the amount of electricity generated.

- Geothermal energy:** The federal Geothermal Investment Tax Credit offers a 26% tax credit for the cost of installing geothermal energy systems.

- Biomass energy:** The federal Biomass Crop Assistance Program offers financial assistance to farmers and landowners who grow crops for bioenergy production.

- Hydroelectric power:** The federal Hydropower Production Tax Credit provides a 1.5 cents per kilowatt-hour credit for electricity generated from qualified hydropower facilities.

Benefits of Tax Incentives

Tax incentives play a crucial role in promoting renewable energy adoption by:

- Reducing the upfront cost:** By lowering the financial barrier, incentives make renewable energy more accessible to a wider range of individuals and businesses.

- Stimulating the market:** Incentives encourage investment in renewable energy technologies, leading to innovation, cost reductions, and job creation.

- Promoting environmental sustainability:** By shifting away from fossil fuels, renewable energy incentives help reduce greenhouse gas emissions and combat climate change.

Looking Ahead

As the demand for renewable energy continues to grow, tax incentives are expected to play an even more significant role in driving the transition to a clean energy future. Governments around the world are exploring new and innovative incentive programs to make renewable energy the most attractive and affordable option for all.

In conclusion, tax incentives are powerful tools for accelerating the adoption of solar and other renewable energy sources. By reducing costs, stimulating the market, and promoting environmental sustainability, these incentives play a vital role in creating a cleaner and more sustainable future for our planet. As technology advances and costs continue to decline, we can look forward to a world powered by clean, renewable energy, ensuring a brighter future for generations to come.

- Efficient DIY Solar Panels Kit

- Type of Solar Panels for Sale

- Net Metering Panel Kit

- Federal Solar Tax Credits

- Solar Battery Systems

- Solar Panel Systems

- Buy Solar Panels

- Solar Engergy Panels

- Lower Your Electiic Bill

- Clean Energy System

- Powerpack Solar Panel Cost

- Home Kits, Off-grid Systems

- Kit Includes

- Utility Panel Rebates

- Best Monocrystalline Panel